Irs Form Schedule B 2024 – The due date to file an updated Income Tax Return (ITR-U) for 2021-22 is declared as 31st March 2024. The Income Tax Department of India has tweeted to alert the taxpayers regarding the approaching . Starting in 2024, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the up from $66,000 in 2023. The IRS also announced defined benefit plan limits for .

Irs Form Schedule B 2024

Source : www.irs.gov

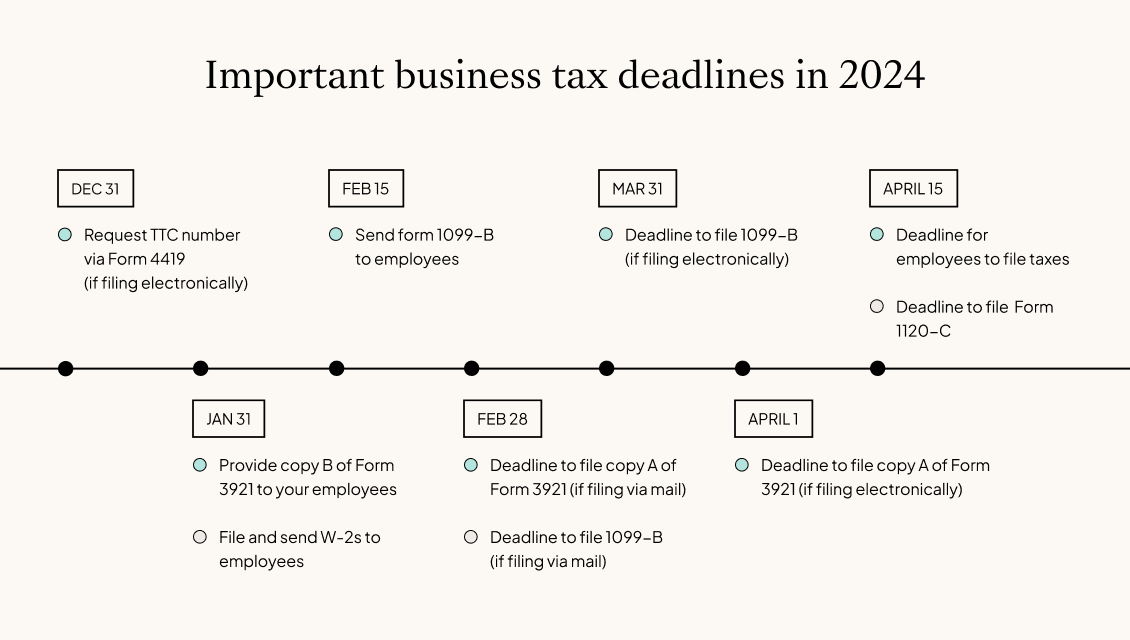

Business tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com

What Is a Schedule B IRS Form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Schedule B (Form 1040) Guide 2023 | US Expat Tax Service

Source : www.taxesforexpats.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

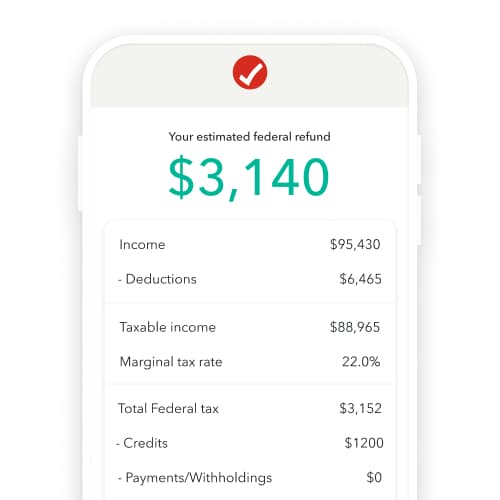

Free Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Current Sophomores & Juniors

Source : saseof.rutgers.edu

Irs Form Schedule B 2024 3.11.13 Employment Tax Returns | Internal Revenue Service: But last year, the IRS delayed the $600 tax reporting rule for payment apps, meaning that similar to prior years, users of cash apps would only receive a 1099-K tax form if they made $20,000 in . most 403(b) and 457 plans are capped at $23,000. Additionally, annual contributions to an Individual Retirement Account (IRA) are now $7,000 in 2024, more than the $6,500 this year. Pre-tax .